Table of Contents

ToggleWhen it comes to Forex trading, indicators and tools play a crucial role in helping traders make informed decisions. But among the myriad of options available, there’s often one tool or indicator that stands out for each trader. In this article, we’ll explore why having a go-to indicator is essential and highlight some of the most popular ones used in Forex trading.

Why Do Traders Rely on Specific Indicators in Forex Trading?

Forex trading requires analyzing vast amounts of data and market trends. Indicators simplify this process by:

- Providing Visual Insights: They make complex market data more accessible.

- Enhancing Decision-Making: Indicators offer signals to help traders enter or exit trades.

- Customizing Strategies: Traders can tailor indicators to fit their trading styles and goals.

For instance, a day trader using RSI might find it invaluable for spotting overbought conditions during high volatility, allowing them to make swift trade decisions.

Popular Forex Indicators Traders Rely On for Forex Trading

1. Moving Averages (MA)

Moving Averages are one of the most commonly used indicators in Forex trading. They smooth out price data to identify trends over a specific period.

- Simple Moving Average (SMA): Averages prices over a set timeframe. For example, a trader might use a 50-day SMA to confirm a long-term trend.

- Exponential Moving Average (EMA): Gives more weight to recent prices for quicker signals. Scalpers often rely on the 9-day EMA for rapid decision-making.

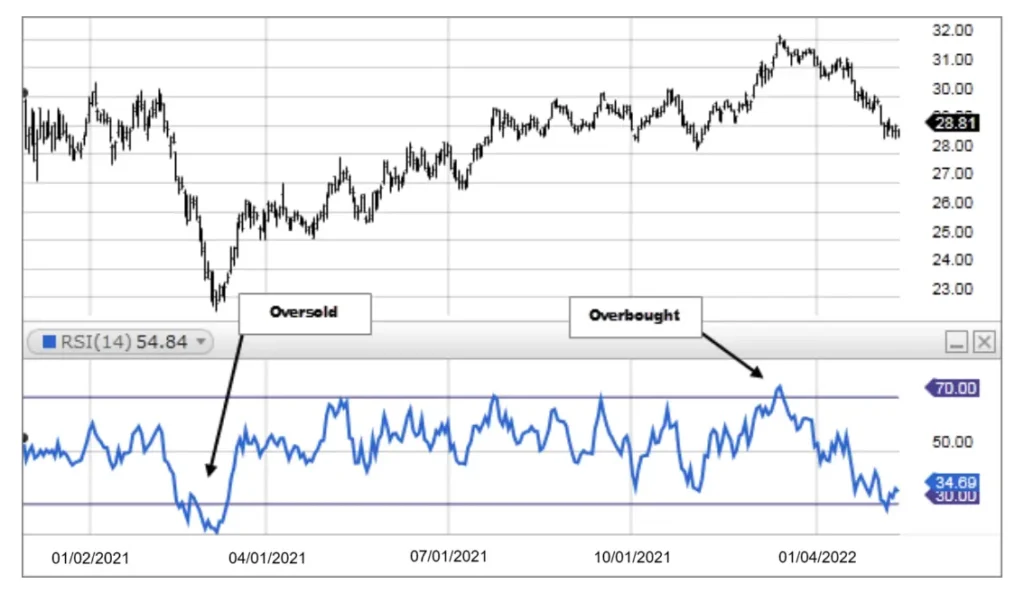

2. Relative Strength Index (RSI)

RSI measures the strength and speed of price movements, helping traders identify overbought or oversold conditions. It operates on a scale of 0 to 100, with values above 70 indicating overbought levels and below 30 signaling oversold levels.

For example, during a volatile market session, a trader noticed the RSI at 25, signaling an oversold condition. They entered a buy position and profited from the subsequent price reversal.

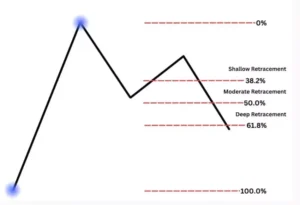

3. Fibonacci Retracement

Fibonacci Retracement levels help traders identify potential support and resistance levels. Based on key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%), this tool is invaluable for planning entry and exit points.

For instance, a swing trader might use the 61.8% retracement level to predict a reversal in an upward trend, allowing them to set a target price effectively.

4. Bollinger Bands

Bollinger Bands consist of a moving average and two standard deviation lines. They help traders identify volatility and potential breakout points, making them ideal for dynamic market conditions.

As an example, a trader noticed the price breaking above the upper Bollinger Band, indicating high volatility. They prepared for a potential retracement and adjusted their stop-loss accordingly.

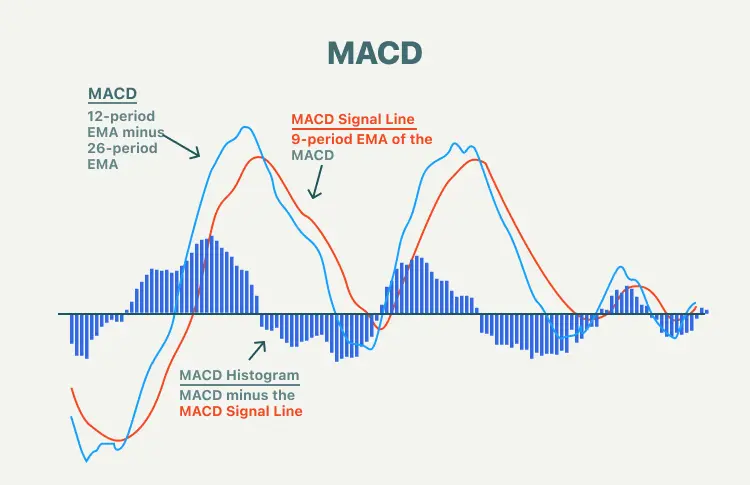

5. MACD (Moving Average Convergence Divergence)

MACD combines two moving averages to show momentum and trend strength. It’s a versatile tool that traders use for trend-following and identifying potential reversals.

For instance, a trader observed a bullish crossover on the MACD, signaling a potential upward trend. They entered a long position and successfully capitalized on the move.

Choosing the Best Tool for Your Forex Trading Strategy

The “one” indicator or tool that works best for you will depend on your trading style:

- Day Traders: Often rely on RSI or Bollinger Bands for quick decision-making. For example, an intraday trader might use Bollinger Bands to predict short-term breakouts.

- Swing Traders: Prefer Fibonacci Retracement or MACD for trend analysis. Swing traders often combine MACD with Fibonacci levels to strengthen their predictions.

- Scalpers: Use tools like EMA for fast-paced trading. Scalpers might rely on a 5-day EMA to navigate rapid market fluctuations.

Conclusion

Every trader has a unique approach to Forex trading, and the right indicator can make a significant difference in their success. While there is no universal “best” tool, experimenting with different indicators and finding the one that aligns with your strategy is key.

For example, if you are a beginner, start with widely-used indicators like Moving Averages or RSI. Test them in a demo account to see how they work in real market conditions.

So, what’s the one indicator or tool you can’t trade without in Forex trading? Share your thoughts and let’s learn from each other!

👉 Want more real trading tips and tools?

Join our growing community of Forex traders on Telegram and get daily insights, strategies, and updates that actually matter.

🔗 Click here to join us

📚 Further Reading You Might Like:

🌟 Top Forex Brokers for Beginners in 2025 – Find the best platforms tailored for new traders.

⚔️ IUX vs TMGM: Forex Broker Comparison 2025 – See how these two brokers stack up against each other.

📈 Forex Analysis: Technical, Fundamental & Sentiment – Master all three core analysis types to improve your trading decisions.

The5ers Prop Firm 2025: The Best Leverage to Kickstart Your Professional Trading Career?