US Dollar Firms Ahead of FOMC Amid US-China Trade Talks and Global Policy Shifts

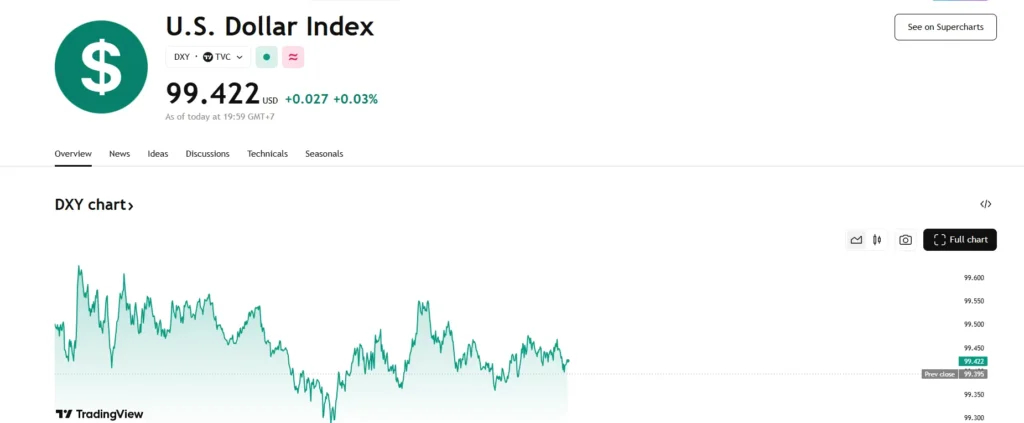

The foreign exchange market opened the week with cautious optimism as traders turned their focus to the upcoming FOMC meeting and a range of pivotal global developments. The US dollar (USD) held firm against most G10 and emerging market currencies, bolstered by stabilizing sentiment around US-China trade relations and expectations surrounding central bank actions across the globe.

US-China Trade Talks Spark Renewed Confidence

Initial trade talks between the United States and China are set to take place this weekend in Switzerland, signaling a possible easing of geopolitical tensions. Although the greenback’s reaction has been measured, the dialogue has contributed to general risk stabilization, offering mild support to Asian equities and currencies.

PBOC Implements Monetary Easing to Stimulate Growth

The People’s Bank of China (PBOC) announced a 10-basis-point cut to its key seven-day repo rate and slashed reserve requirements by 0.5%, releasing around CNY 1 trillion into the financial system. These steps are aimed at stimulating credit growth and supporting a slowing economy. The offshore yuan (CNH) initially rallied, but gains were capped by cautious dollar strength.

FOMC to Hold Rates Steady, Market Eyes Powell’s Tone

The US Federal Reserve is expected to leave interest rates unchanged. While markets previously priced in a June rate cut, expectations have shifted toward a possible move in July. Fed Chair Jerome Powell is likely to emphasize the Fed’s data-dependency and the resilience of the US economy, although softer Q1 GDP will be acknowledged.

European Central Banks Poised for Action

In Europe, strong German factory orders suggest underlying resilience in the manufacturing sector. However, both Poland and the Czech Republic are expected to cut rates today amid declining inflation and slowing growth. The euro (EUR) responded positively to the factory data but remains range-bound ahead of broader ECB policy cues.

Emerging Market Volatility Remains Elevated

Asian currencies showed mixed performance, with the South Korean won and Philippine peso gaining ground. Meanwhile, geopolitical tensions between India and Pakistan have led to currency and equity market instability, particularly in Pakistan. Latin American currencies such as the Brazilian real and Mexican peso also faced pressure ahead of rate decisions and inflation data releases.

Commodity Currencies Show Mixed Signals

The Canadian dollar (CAD) and Australian dollar (AUD) posted gains earlier in the week but faced pullbacks amid profit-taking and weaker trade data. The AUD, in particular, tested key resistance levels before retreating below $0.6500.

Conclusion:

As the Forex market navigates a dynamic global backdrop, the US dollar remains a central focus. Traders await the FOMC decision, but global monetary easing, trade negotiations, and geopolitical developments will continue to drive currency movements through the week.

📢 What’s your take on the recent US-China trade talks and their impact on the USD and Forex markets?

Leave your thoughts in the comments below — we’d love to hear from you!

If you found this Forex news update helpful, share it with other traders and help grow our trading community. 📊💬