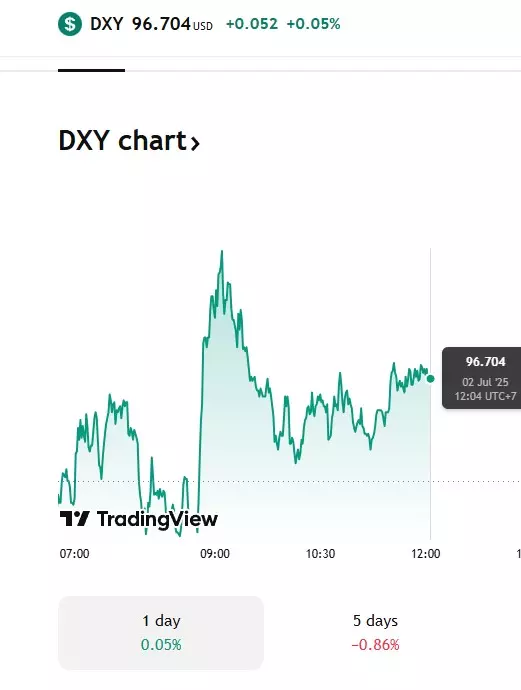

USD Index Today: Dollar Hits 3.5-Year Low Amid Broad Weakness

As of July 2, 2025, the U.S. Dollar Index (DXY) — which measures the dollar against a basket of six major currencies — stood at 96.677, just slightly above the session low of 96.373. This is the weakest level since February 2022, nearing a 3.5-year low, according to data from Reuters.

👉 For traders looking to capitalize on this volatility, choosing the right prop trading firm is more critical than ever.

📌 Key Reasons Behind the Dollar’s Decline

Dovish Signals from the Federal Reserve

Fed Chair Jerome Powell stated at the ECB’s annual conference in Sintra, Portugal that while the Fed is taking a cautious stance, it does not rule out a rate cut this month.“We remain patient, but nothing is off the table,” – Powell said.

Trump’s Massive Tax-and-Spending Bill

The new bill, proposed by former President Donald Trump, could add $3.3 trillion to U.S. national debt. It has already passed the Senate and is awaiting House approval, fueling fiscal concerns that are dragging down the dollar.Political Pressure on the Fed

Trump’s continued attacks on Powell have raised questions about Fed independence. He even handwrote notes comparing U.S. rates to global peers, urging more aggressive rate cuts.

📈 Major Currency Movements

EUR/USD: Holding at 1.1802, near a session peak of 1.1829 — highest since 2021.

USD/CHF: Steady at 0.7906 after dipping to 0.7873, lowest since January 2015.

USD/JPY: Slight recovery to 143.59 after a 0.4% drop the previous session.

💡 Summary: Sustained Downtrend Ahead?

With a dovish Fed, massive fiscal stimulus, and political instability, the dollar faces continued downward pressure. Market participants are closely watching the Non-Farm Payrolls report due Thursday. Weak labor data would increase the likelihood of a July rate cut, potentially driving the dollar even lower.

For deeper analysis on navigating this uncertain environment, explore our breakdown on what makes a prop firm legit in 2025 — especially if you’re considering funding your trades through external capital.

🔎 Forex Strategy Recommendations

Market Bias: Bearish USD outlook continues in the short term.

Suggested Trades: Long EUR/USD, short USD/CHF or USD/JPY.

Risk Management: Use tight stop-loss levels around key U.S. economic data releases.

⚠ Disclaimer

This article is based on publicly available sources including Reuters, Trading Economics, and Investing.com. It is for informational purposes only and does not constitute financial advice. Investors are advised to conduct independent research before making trading decisions.

Published: July 2, 2025

Sources: Reuters, Trading Economics, Investing.com