Table of Contents

Toggle📌Top Prop Firms 2025

In the rapidly evolving prop trading market, choosing a reputable, transparent prop firm that aligns with your personal trading style is no easy task. This article provides a detailed overview of the top three standout firms of 2025: BlueGuardian, EquityEdge, and The5ers. Additionally, it highlights the differences between these firms and emerging platforms like For Traders, a rising name known for its exceptionally fast payouts.

🔵 BlueGuardian – Transparent and Flexible, But Not for Everyone

Established in 2022 in the United Kingdom, BlueGuardian has become a familiar name among modern traders thanks to its clear, transparent management style and emphasis on trading freedom. Unlike many other prop firms that impose restrictions on news trading or Expert Advisors (EAs), BlueGuardian allows scalping, news trading, and even the use of EAs—making it highly suitable for those pursuing short-term or automated strategies.

Established in 2022 in the United Kingdom, BlueGuardian has become a familiar name among modern traders thanks to its clear, transparent management style and emphasis on trading freedom. Unlike many other prop firms that impose restrictions on news trading or Expert Advisors (EAs), BlueGuardian allows scalping, news trading, and even the use of EAs—making it highly suitable for those pursuing short-term or automated strategies.

They offer two main challenge models: One Phase and Two Phase, with profit-sharing rates of up to 85%, ranking among the highest in the market. Additionally, their support for MT4, MT5, and cTrader platforms provides traders with familiar options when getting started.

However, BlueGuardian isn’t for everyone. Profit withdrawal times typically take seven days or more—not excessively slow, but not as fast as firms like For Traders, which promise processing within 48 hours. Moreover, the entry fees, especially for accounts starting at $100K or above, are considered somewhat steep compared to the industry average.

Despite these drawbacks, BlueGuardian remains an attractive option for traders with stable strategies who value flexibility and a dynamic community—particularly as their lively Discord channel features many admins who are experienced traders themselves.

👉 Best suited for experienced traders who value trading freedom and aren’t overly concerned about ultra-fast profit withdrawals.

💬 Community Feedback (Compiled from Trustpilot & Reddit)

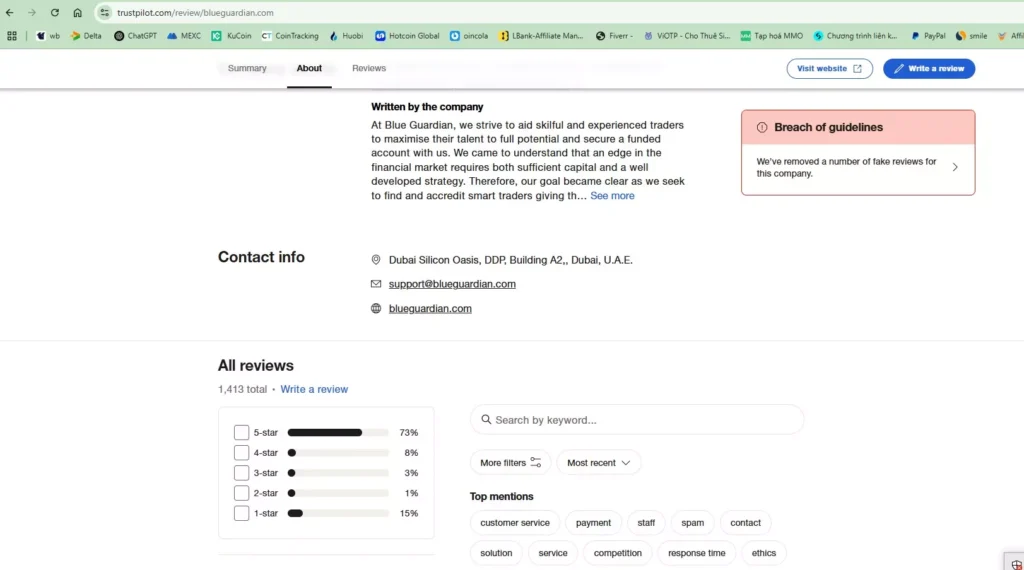

As of June 2025, BlueGuardian has received over 1,100 reviews on Trustpilot, with an average rating of 4.2/5 stars—indicating that most traders hold a positive view of the firm’s service quality and transparency.

Approximately 72% of the reviews are 5-star ratings, praising timely payouts, responsive support via Discord, and smooth trading experiences on platforms like MT5 and cTrader.

Around 10% of the reviews are 1-star ratings, mainly from cases where payouts were denied due to terms violations—particularly rules related to trade volume, hedging, or holding times.

On Reddit and Discord groups dedicated to prop firms, many traders have shared that they successfully withdrew profits from BlueGuardian multiple times without issues. However, they recommend reading the terms carefully for each challenge type, as different account packages have unique requirements.

📌 Suggestions for Beginners:

Like any other prop firm, BlueGuardian cannot satisfy everyone. Therefore, if you’re trying BlueGuardian for the first time, consider starting with a small challenge account ($10K–$25K) to get a feel for the experience, or use the free demo if you’re still unsure.

🟢 EquityEdge – A Modern Prop Firm for Technical Traders

Launched in 2023 in the United States, EquityEdge quickly stood out with a clear mission: to build a prop firm platform centered on technology, transparent performance tracking, and comprehensive training support. A key feature of their offering is the intuitive dashboard, where traders can monitor profits, drawdowns, and risks for each trade and each day. This makes it easier for serious traders to manage their trading behavior effectively.

Unlike many prop firms focused solely on forex, EquityEdge expands into stocks and crypto and features a no-KYC policy during the evaluation phase—a significant advantage for those valuing privacy and seeking a no-strings-attached trial experience.

However, the platform is still in its expansion phase, so the available challenge account sizes are limited, primarily ranging from $10K–$50K. Additionally, they lack a 24/7 support system, which can sometimes lead to delayed responses, particularly for international traders.

Nonetheless, if you’re a trader with a focus on technical analysis, appreciate a detailed performance tracking system, and seek mentorship from professional guides, EquityEdge is well worth a try. Its user-friendly interface, transparent processes, and educational mindset set it apart.

👉 Ideal for traders who love technology, logical trading, and a structured learning environment.

💬 Community Feedback – EquityEdge

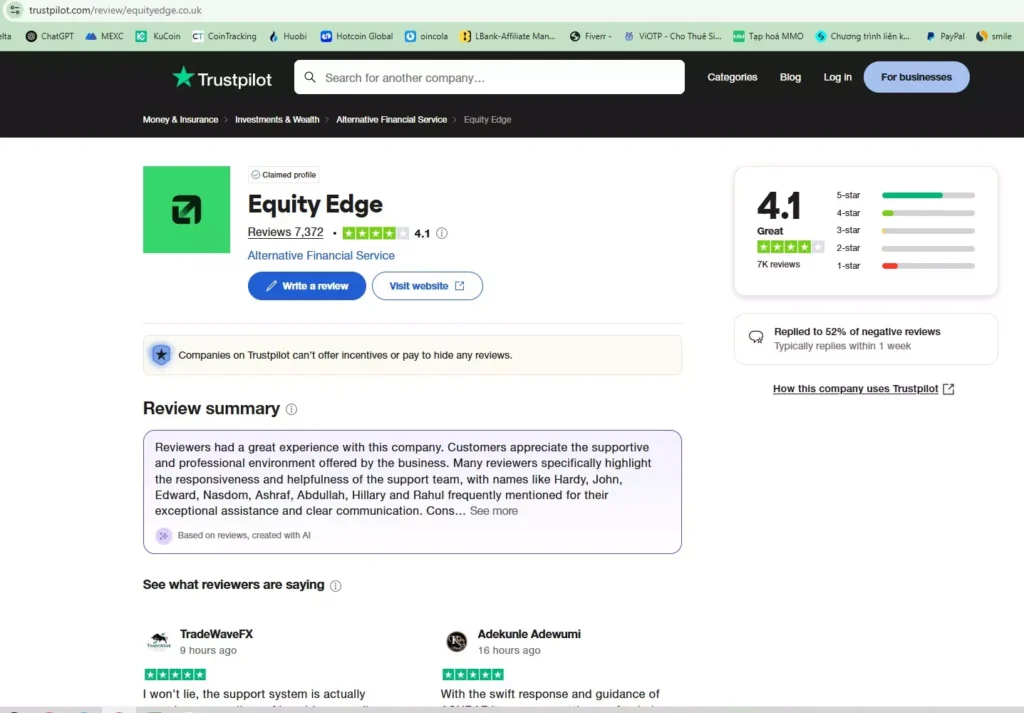

As of June 2025, EquityEdge has received over 7372 reviews on Trustpilot, with an average rating of 4.1/5 stars. This is quite impressive for a prop firm that was only established in 2023.

Approximately 68% of the reviews are 5-star ratings, highlighting positive experiences with:

– An intuitive dashboard that allows daily profit/loss tracking

– Free mentorship programs for new traders

– Quick responses from the support team via live chat and email

About 14% of the reviews are 1-star ratings, mostly from traders facing issues during account verification or misunderstandings about the conditions for first-time payouts. Some new traders also mentioned unclear refund procedures when failing challenges.

On Reddit and forums like ForexFactory, some traders shared that they prefer EquityEdge for its “human touch” compared to automated prop firms. However, they acknowledged that the platform is still a work in progress and has some minor shortcomings.

📌 Suggestions for Beginners:

If you’re looking to learn while taking on a challenge, EquityEdge is a worthwhile option. Start with an account between $10K–$25K, carefully review the payout conditions, and take advantage of the free mentorship during your first attempt.

🟡 The5ers – An Ideal Choice for Patient and Professional Traders

Founded in 2016 in Israel, The5ers is one of the oldest prop firms with one of the most comprehensive training systems in the industry. Unlike many platforms that focus on “quick payouts and scalping,” The5ers stands out with its slow-and-steady strategy, emphasizing long-term career development for traders.

Their flagship program, the “Growth Program,” allows traders to start with a small capital base but provides steady capital increases based on performance and time in the market. Additionally, their Instant Funding program enables experienced traders to start earning immediately without going through rigorous challenge phases.

However, success with The5ers requires a high level of discipline. Their risk management system is strict, with limitations on drawdown, position size, and holding periods. Moreover, capital growth takes time, making it unsuitable for those hoping for rapid success within a few months.

With a seasoned team, stable platform, and a large community across Europe, The5ers remains an ideal destination for traders who are persistent, professional, and have a clear career mindset in trading.

👉 Best suited for veteran traders or those aiming for a serious, structured, and long-term trading career.

💬 Community Feedback – The5ers

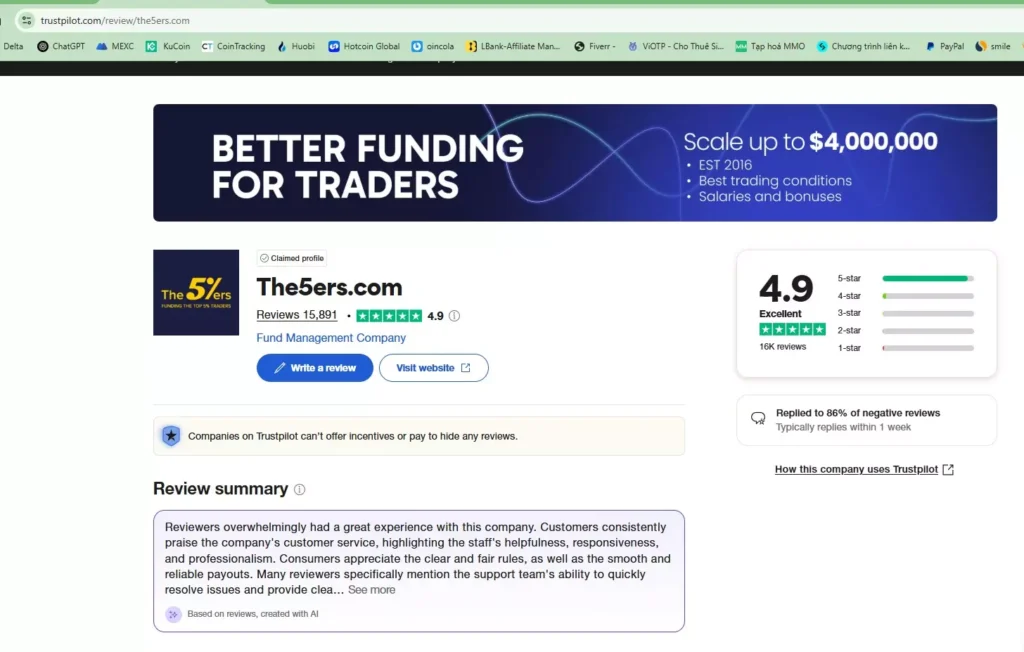

As one of the veteran prop firms, The5ers has garnered over 15891 reviews on Trustpilot as of June 2025, with an impressive average rating of 4.9/5 stars—ranking among the most trusted in the industry.

More than 90% of the reviews are 5-star ratings, praising:

– Clear and sustainable long-term capital growth through the Growth Program.

– Support for various account types, especially Instant Funding.

– Friendly staff who typically respond within a few hours.

Around 2% of reviews are 1-star, focusing on concerns like slightly delayed payouts (5–10 days) and a risk management system that can be “confusing” for new traders.

Seasoned traders on Discord, Quora, and Reddit commend The5ers for its stability and transparency. However, they often advise newcomers to thoroughly understand the rules on risk management and drawdown before committing to long-term programs.

📌 Suggestions for Beginners:

If you’re serious about building a long-term trading career, The5ers is an excellent choice. Be sure to read their capital management policies carefully, start with a smaller account, and consider Instant Funding if you’re not yet familiar with their Bootcamp system.

Comparison of Top Prop Trading Firms in 2025

This table summarizes key differences among the top three prop firms in 2025, including their founding year, unique features, profit sharing structure, payout speed, and their main strengths. Use it to quickly decide which firm aligns best with your trading style and career goals.

| Firm | Founded | Main Features | Profit Share | Payout Speed | Key Strengths |

|---|---|---|---|---|---|

| BlueGuardian | 2022 UK | Flexible, supports EA, scalping | Up to 85% | ~7 days | Strong community, transparent |

| EquityEdge | 2023 US | Detailed dashboard, mentorship | Up to 80% | ~5 days | No KYC in evaluation, stocks & crypto |

| The5ers | 2016 Israel | Slow and steady growth approach | ~70–80% | 5–10 days | Growth Program, Instant Funding |

✍️ Personal Insights and Final Advice

From my personal perspective, there is no such thing as a “perfect” prop firm for everyone. Each platform has its own strengths:

– BlueGuardian suits those who value flexibility and an active trading community.

– EquityEdge is ideal for traders who love technology and technical analysis.

– The5ers is perfect for those pursuing a serious and long-term trading career.

That said, the most important thing is to understand yourself as a trader:

Are you someone who thrives on high risk or prefers a slow and steady approach? Do you need fast withdrawals or long-term education and support? Answering these questions will help you choose the right platform and avoid unnecessary disappointment.

🔔 Important Note:

All information in this article is intended for informational and reference purposes only. It should not be considered financial advice. Before joining any prop firm, please conduct thorough research (DYOR), read the terms and conditions carefully, and consider starting with a smaller account before making long-term commitments.

Invest with knowledge – not just emotion.

📚 You May Also Like

If you’re exploring prop firms and looking for trustworthy insights, here are a few hand-picked articles worth reading:

-

🔎

Is Maven Trading a Scam?

A deep dive into the controversial reputation of Maven Trading and what traders are really saying. -

🌱

Blueberry Funded Review 2025

A detailed analysis of Blueberry Funded’s latest program and payout performance. -

⚡

For Traders Review 2025 – Is It Legit?

Discover why this fast-rising firm is gaining attention for 48-hour payouts.

Stay informed and make the best choice for your trading journey.