Table of Contents

ToggleUSD Weekly Outlook: June 22–28, 2025 – This week’s analysis comes at a crucial turning point as the US Dollar faces growing uncertainty. From potential Fed rate cuts to global volatility and shocking market forecasts, the USD Weekly Outlook sheds light on what traders and investors should prepare for. All eyes are on the dollar as it navigates economic crosswinds that could reshape short-term strategies and long-term trends.

Written by the SmartFXGuide Editorial Team

Current Market Overview (as of June 22, 2025)

EUR/USD: The euro closed the week at 1.1525, moving within a relatively tight range of 1.1475 to 1.1570. According to The Wall Street Journal, the pair settled at 1.1524 on June 20. This aligns with data from Exchange-Rates.org, which also recorded a closing rate of 1.1525. The pair’s stability reflects the market’s response to the Fed’s decision to hold rates steady.

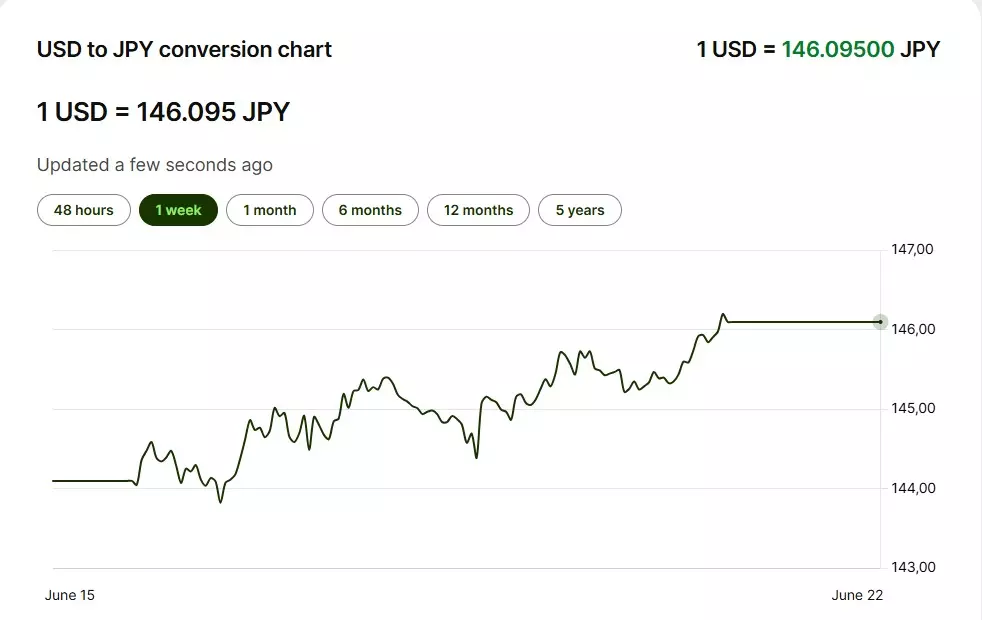

USD/JPY: The dollar-yen pair hovered between 144 and 146, supported by continued demand for safe-haven assets. This trend is further reinforced by the Bank of Japan’s ongoing commitment to ultra-loose monetary policy.

USD/JPY: The dollar-yen pair hovered between 144 and 146, supported by continued demand for safe-haven assets. This trend is further reinforced by the Bank of Japan’s ongoing commitment to ultra-loose monetary policy.

DXY Index: The US Dollar Index (DXY) posted minor weekly fluctuations—around ±0.2%—signaling a market in wait-and-see mode. The index remains supported by solid US fundamentals but faces headwinds from global economic uncertainty and shifting investor sentiment.

Key Factors to Watch

Chairman of the Federal Reserve delivering a speech on June 18, 2025, highlighting US interest rate policy and economic outlook

Fed Holds Rates at 4.25–4.50%: In its June 18 meeting, the Federal Reserve confirmed its decision to maintain interest rates, while signaling two potential rate cuts before the end of the year (source: Washington Post). This cautious stance has set the tone for market expectations in the coming months.

US Economic Activity: Upcoming reports on consumer spending and retail sales are expected to play a pivotal role in shaping the USD’s short-term trajectory. Strong data could temporarily boost the dollar, while any weakness may reinforce expectations of monetary easing.

Geopolitical Tensions: Escalating unrest in the Middle East continues to fuel demand for safe-haven assets, benefiting both the USD and JPY. Investors remain sensitive to global risk events, which could trigger sharp currency flows.

Long-Term USD Weakness Forecast: Morgan Stanley and several major financial institutions project that the USD may depreciate by around 9% over the next 12 months. This outlook is driven by anticipated Fed rate cuts and the relative strengthening of other global currencies, placing long-term downward pressure on the dollar.

Short-Term Forecast (Week of June 22–28, 2025)

EUR/USD:

The pair is expected to remain within the range of 1.1450–1.1600, as upcoming economic data—particularly on consumer spending and retail sales—could prompt only moderate market reactions. With the Federal Reserve maintaining a cautious stance and signaling future rate cuts, the euro may gain some ground, but the overall movement is likely to be restrained by limited surprises in macroeconomic indicators.

USD/JPY:

Forecasted to fluctuate between 142 and 146, depending on geopolitical developments and any signals from the Bank of Japan (BOJ). Continued unrest in the Middle East is expected to support demand for safe-haven currencies like the yen, while the BOJ’s ultra-loose monetary policy may cap any significant yen appreciation. This dynamic keeps the dollar-yen pair in a relatively tight but reactive range.

Sources & References

- Wall Street Journal – Market Close Data, EUR/USD Closing Price (June 20, 2025)

- Investing.com – USD Performance & Fed Outlook

- Exchange-Rates.org – Currency Closing Rates

- Morgan Stanley – USD 12-Month Depreciation Forecast

- Federal Reserve – June 2025 Rate Decision & Policy Statement

- Bloomberg – Fed Outlook and Market Reactions, Week of June 17–21, 2025

🔍 Explore More from SmartFXGuide:

If you’re looking to build a solid foundation in forex trading or take your strategy further, here are a few hand-picked resources you shouldn’t miss:

📘 Forex Basics: What Every Beginner Should Know – A comprehensive guide to help you understand the fundamentals of currency trading before making your first move.

🧾 Choosing the Right Forex Trading Account – Not all accounts are created equal. Learn how to match your trading goals with the right account type and risk strategy.

💼 For Traders Prop Firm Review: Is It Legit in 2025? – Discover how traders are getting funded and paid in just 48 hours. A full breakdown of rules, payouts, and real user feedback.

These resources are designed to complement your weekly analysis and help you make better-informed decisions in the forex market.